Does South Carolina Have A State Withholding Form . if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the.

from www.withholdingform.com

if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the.

South Carolina State Tax Withholding Form

Does South Carolina Have A State Withholding Form if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the.

From www.uslegalforms.com

Articles Of Incorporation South Carolina Withholding Tax US Legal Forms Does South Carolina Have A State Withholding Form if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. if you are a resident of south carolina and earn wages. Does South Carolina Have A State Withholding Form.

From www.withholdingform.com

State Tax Withholding Forms 2022 Does South Carolina Have A State Withholding Form you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. (a) an employer paying wages to an employee shall withhold income tax for that. Does South Carolina Have A State Withholding Form.

From www.formsbank.com

South Carolina W4 Employee'S Withholding Allowance Certificate 2009 Does South Carolina Have A State Withholding Form if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if the employee is working in south carolina, regardless of where they. Does South Carolina Have A State Withholding Form.

From www.withholdingform.com

South Carolina State Withholding Form Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. you must withhold south carolina state taxes at the same time. Does South Carolina Have A State Withholding Form.

From www.withholdingform.com

South Carolina State Withholding Forms For Employees Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. (a) an employer paying wages to an employee shall withhold income. Does South Carolina Have A State Withholding Form.

From www.formsbank.com

Nonresident Taxpayer Affidavit Of Exemption From Withholding Of State Does South Carolina Have A State Withholding Form you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if the employee is working in south carolina, regardless of where he/she is a resident,. Does South Carolina Have A State Withholding Form.

From www.slideserve.com

PPT South Carolina Withholding and Forms W2 PowerPoint Presentation Does South Carolina Have A State Withholding Form (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if the employee is working in south carolina, regardless of where they are a resident,. Does South Carolina Have A State Withholding Form.

From www.withholdingform.com

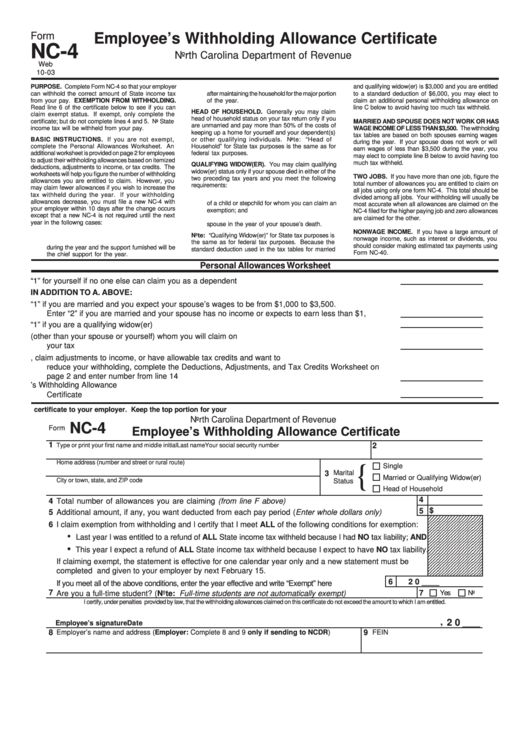

North Carolina Tax Withholding Form 2022 Does South Carolina Have A State Withholding Form if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if you are a resident of south carolina and earn wages in. Does South Carolina Have A State Withholding Form.

From printableformsfree.com

State Withholding Tax Form 2023 Printable Forms Free Online Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. (a) an employer paying wages to an employee shall withhold income tax for that. Does South Carolina Have A State Withholding Form.

From www.templateroller.com

Form SC1120SWH Download Printable PDF or Fill Online Withholding Tax Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if the employee is working in south carolina, regardless of where they are a. Does South Carolina Have A State Withholding Form.

From printableformsfree.com

Sc W4 Form 2023 Printable Forms Free Online Does South Carolina Have A State Withholding Form if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if you are a resident of south carolina and earn wages. Does South Carolina Have A State Withholding Form.

From games.assurances.gov.gh

Sc Withholding Tax Form Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if the employee is working in south carolina, regardless of where they are a resident, the income earned in south carolina is taxed. if the employee is working in south carolina, regardless of where. Does South Carolina Have A State Withholding Form.

From www.slideserve.com

PPT South Carolina Employer Withholding Tax The Basics of Filing and Does South Carolina Have A State Withholding Form if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. (a) an employer paying wages to an employee shall withhold income. Does South Carolina Have A State Withholding Form.

From www.withholdingform.com

State And City Tax Withholding Form Does South Carolina Have A State Withholding Form you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. if the employee is working in south carolina, regardless of where they are a. Does South Carolina Have A State Withholding Form.

From www.formsbank.com

Top 33 South Carolina Withholding Form Templates free to download in Does South Carolina Have A State Withholding Form taxpayers who withhold $15,000 or more per quarter, or who make 24 or more withholding payments in a year, must file and pay. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. you must withhold south carolina state taxes at the same time. Does South Carolina Have A State Withholding Form.

From www.uslegalforms.com

South Carolina Deed Withholding Form 2023 US Legal Forms Does South Carolina Have A State Withholding Form if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. you must withhold south carolina state taxes at the same time. Does South Carolina Have A State Withholding Form.

From www.formsbank.com

Top 33 South Carolina Withholding Form Templates free to download in Does South Carolina Have A State Withholding Form you must withhold south carolina state taxes at the same time wages are earned by employees working in south carolina. if you are a resident of south carolina and earn wages in a state that does not have a state income tax, the. taxpayers who withhold $15,000 or more per quarter, or who make 24 or more. Does South Carolina Have A State Withholding Form.

From www.formsbank.com

Form Wh1647 Withholding Return Packet South Carolina Department Of Does South Carolina Have A State Withholding Form (a) an employer paying wages to an employee shall withhold income tax for that employee if at the time of payment the. if the employee is working in south carolina, regardless of where he/she is a resident, the income earned in south carolina is taxed. you must withhold south carolina state taxes at the same time wages. Does South Carolina Have A State Withholding Form.